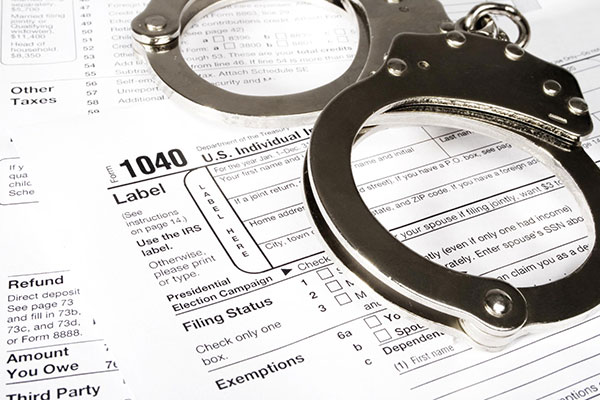

Facing tax evasion charges, IRS fraud or another federal crime? Avoid prison and heavy fines by hiring an experienced white collar defense lawyer to fight for your civil rights.

As Founding Father Benjamin Franklin once wrote, “in this world nothing can be said to be certain, except death and taxes.” That doesn’t stop some people and businesses from trying to evade taxes or defraud the government, and the Internal Revenue Service (IRS) can be relentless in their quest to prove guilt and punish offenders – even when criminal fraud has not actually occurred.

If the IRS is investigating you for tax evasion or fraud, it is imperative that you talk to a knowledgeable defense lawyer who focuses on federal cases involving government fraud as soon as possible. Houston white collar defense attorney Neal Davis, a believer of the law that everyone is “innocent until proven guilty,” provides aggressive representation for individuals in Texas and nationwide who have been accused of a federal crime like tax evasion or government fraud.

Federal tax fraud investigations typically go as follows:

The defendant receives a letter from the IRS Criminal Investigation Division (CID).

The IRS contacts you, your family, friends or colleagues to build their case. The defendant’s home or office is searched or raided by armed IRS Special Agents and federal marshals.

The defendant is arrested and formally charged.

Time is not on your side and this problem will not “just go away.”

Contact our experienced white collar defense law firm right way. The first consultation is on us.

Schedule an AppointmentTax Fraud: Definitions & Examples

We often receive questions from concerned citizens and companies who fear the punishments of being convicted of government or tax fraud. Such questions include:

- Can I go to prison for tax evasion?

- Is tax evasion a felony?

- What’s the difference between tax evasion and tax avoidance?

- Can I go to jail for lying on my tax return?

Tax fraud is defined by the IRS as “an intentional wrongdoing, on the part of a taxpayer, with the specific purpose of evading a tax known or believed to be owing. Tax fraud requires both: a tax due and owing; and fraudulent intent.” Making a mistake or being careless when filing tax returns is not a crime. The IRS must prove “beyond a reasonable doubt” that the defendant purposefully tried to defraud the government and commit tax evasion.

The difference between tax fraud and tax avoidance is a subtle but crucial distinction. Avoidance is the right of every citizen and organization to reduce their tax responsibility through legal and legitimate means, such as claiming dependants, itemizing deductions, etc. Fraud, on the other hand, is when an individual or business entity intentionally conceals or misrepresents information to evade or eliminate the payment of taxes.

What qualifies as criminal tax fraud?

YES

- Intentional understatement or omission of income

- Claiming fictitious or improper deductions

- False allocation of income

- Improper claims, credits or exemptions

- Concealment of assets

- Intentionally providing false information on a tax return

- Refusing to file your tax returns

NO

- Negligence or carelessness when filling out information on your tax return, accidentally resulting in false information

- Confusion regarding what you can claim as an exemption or credit

- Tax avoidance

- Forgetting to file your tax return by the deadline (though you still may be forced to pay a fine)

Knowing how the government defines fraud and what constitutes tax evasion is an important step toward understanding the penalties you may face if convicted of this federal crime.

Penalties for Tax Evasion & Government Fraud

Tax evasion or fraud is a felony offense under federal criminal law. While each state may have their own provisions and sentencing guidelines regarding government fraud crimes, generally a tax evasion conviction for an individual can result in up to 5 years in prison and a $250,000 fine. Businesses convicted of tax fraud can be fined up to $500,000. Restitution and probation may also come into play during sentencing.

In addition to facing prison time and fines, a person convicted of tax fraud may suffer irrevocable damage to their reputation, career, finances and family life.

As the following data from the IRS Criminal Investigation Division’s 2016 report indicates, there is often little mercy shown to tax fraud offenders.

Number of criminal investigations initiated = 3,395

Number of prosecutions recommended = 2,744

Number of convictions = 2,672

Number of those sentenced = 2,699

*Sentence includes confinement to federal prison, halfway house, home detention, or some combination thereof.

Percentage of defendants sent to prison = 79.9%

Average number of months served = 41

As you can see, the IRS has incredibly high conviction (97.4%) and sentencing (98.4%) rates in tax fraud cases – and a high percentage of these convictions lead to multiple year prison terms. Why? One contributing factor is that many defense lawyers who claim to be “former IRS agents” or “former federal prosecutors” are still cozy with their former colleagues and earn bonuses by agreeing to settlements that benefit the government more than their client.

To secure the best possible outcome in your case, you need to hire an experienced government tax fraud defense attorney who has your best interests at heart and who can devote the time needed to build a strong case in your favor.

“I had a previous lawyer who I felt was not doing enough for my case. The first time meeting with Neal, I was treated with kindness and he listened very closely to what I had to say. As soon as I explained my situation to him he mapped out a plan for defense, worked with me on a payment plan, and worked vigorously on my case. The allegations brought against me were truly false and to have a lawyer as attentive, caring, and knowledgeable as Neal was a Godsend! I know it seems too good to be true, but if you are in need of counsel, I would definitely give Neal a call. Thank you so much, Neal!”

Houston | Client’s White-Collar Fraud Case Dismissed

Verified Customer

Common Tax Fraud Defense Strategies

Beating the federal government and IRS in court is extremely difficult and often an uphill battle for defendants. Fortunately, there are a few tactics tax evasion lawyers may employ to secure the best possible outcome in your case:

- Time limit. The IRS must file tax evasion charges within six years from when the alleged crime supposedly occurred. If this time period has passed, the government’s claim is invalid based on the statute of limitations.

- Entrapment. If the government compels a person or company to commit fraud when they would not have otherwise, the defense of entrapment may be used.

- Mental instability. Lastly, insanity is always an option when disputing a criminal charge. However, this defense strategy should only be used as a last resort since it is rarely effective in tax evasion cases.

- Question evidence. Your defense lawyer can call into question the evidence presented by the prosecution, arguing that the IRS cannot prove “beyond a reasonable doubt” that you willfully defrauded the government or evaded taxes.

- Carelessness. The burden of proof rests on the prosecution to prove the defendant intentionally committed tax fraud or evasion, fully knowing the consequences of their actions. The defense can make the argument that the defendant did not act purposefully, but rather made a mistake or were forgetful.

To learn more about these and other defense strategies for your government fraud case, or to consult an experienced tax evasion lawyer, contact the Neal Davis Law Firm of Houston, Texas.

White collar defense attorney Neal Davis has successfully defended clients in Texas and federal courts for over 25 years , from state misdemeanors to high-profile federal investigations. As a skilled trial litigator and aggressive negotiator, he can often favorably resolve cases quickly and quietly with the IRS, without the need for trial.